Hello, I'm Nina.

Photograph: blocks by Unsplash

Today, I need to pay overseas for my honeymoon, so I brought an overseas cashback card to solve my concerns about whether to take dollars or credit cards.

There are two in total.

Toss Bank Check Card

Kookmin Card Heritage Smart Discount Type

The main benefit of both is an unlimited 3% discount for overseas use. It's incredible!

But there's a difference, so let's take a look at that.

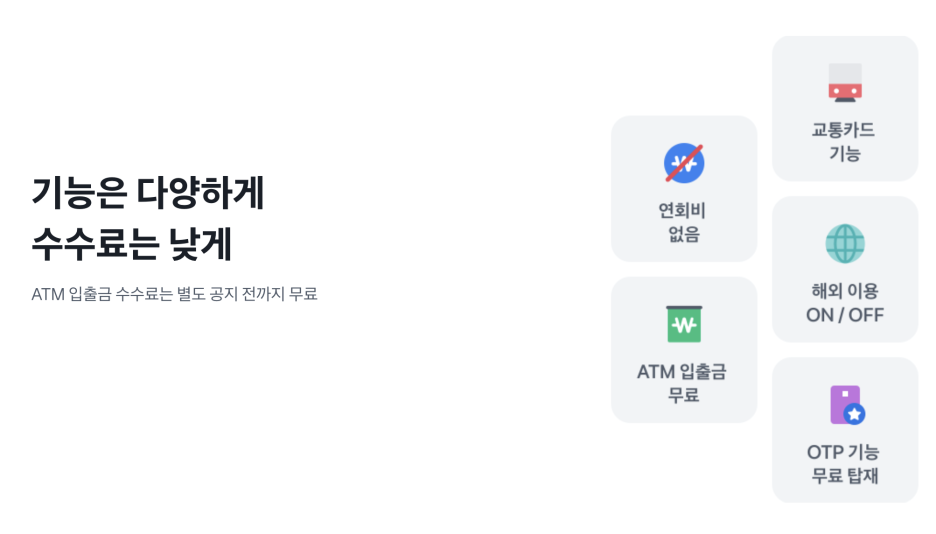

Going to get a Toss card issued

For overseas cashback, the amount excluding 1% of international brand fee (Mastercard) and overseas service fee (US$0.5 per case) will be cashback.

Travel-related merchants such as airlines, hotels, accommodations, and rental cars apply the exchange rate on the date of final payment, not the exchange rate of the payment request at the time of card approval.

If the exchange rate goes up, the amount could be higher than expected.

If you make a payment and cancel (including partial cancellation), 3% of the cancellation amount of KRW conversion will be withdrawn from the account again.

Depending on the exchange rate at the time of cancellation, the cashback and cancellation cashback amount may be different.

Overseas cashback is provided only for foreign currency payments such as USD.

Overseas cashback is provided only for the amount paid with an overseas Mastercard.

This benefit can be extended or terminated earlier than scheduled due to the circumstances of Toss Bank and its affiliates.

You can find detailed explanations of Toss Bank's debit card on the Toss app.

In the case of Toss, the KRW payment is double-exchange and there is an additional fee, so the overseas KRW payment blocking setting is made possible on the app.

Of course, it is possible to block overseas use. :)

Now, let's look at the Kookmin Card Heritage Smart Discount Type.

The annual fee for this card is as much as 200,000 won.

It's very expensive, but the amount of 150,000 won will be offset by the special coupon provided once a year below. So the burden will be about 50,000 won. Of course, only if you use a hotel, airline ticket, or performance exhibition.

3 discount coupons/choose 1, 1~3% for domestic and foreign franchises, 5% for special areas - KB Kookmin Card

View annual fees Major benefits of MasterCard in Korea Major benefits HERITAGE Exclusive benefits Major benefits Basic services 1~3% Discount on domestic and foreign franchises 5% Discount on special services Domestic franchises 1% + 5% Annual fees Please check before using the product manual. Card Common Information Please check the product manual and terms and conditions before applying for the card. Issuing and using more credit cards than necessary may affect personal credit ratings or usage limits. Financial consumers have the right to receive explanations for the relevant goods or services pursuant to Article 19 (1) of the Financial Consumer Act, and the explanation...

m.kbcard.com

There is also a 3% charge discount when using overseas franchises. And there are no previous month's usage records and conditions, and the accumulation limit is unlimited.

However, if there is a difference from Toss Card, the international brand fee is the same.

0.25% will be charged as a percentage instead of Toss Card's overseas service fee (US$0.5 per case).

There is a difference between Toss card and overseas service fee.

In Nina's opinion, Toss Card, which has a fixed amount per case, is more advantageous as the payment is less and the amount is larger. And it has the advantage of not having an annual fee.

In the case of Kookmin Card, the advantage is that the fee burden is low because it is applied as a percentage.

I think I'll probably choose the Kookmin Card Heritage smart discount type. :)

At first, when I looked for a card with a high refund amount for overseas use, I was very happy to find a 3% card.

Have a good day~!